Know About the Transmission of Shares

Have you ever found yourself in a situation where shares of a company need to be transferred due to the unfortunate death or incapacitation of a shareholder? This situation can feel overwhelming, especially when the legalities come into play. But don’t worry, this blog will break down everything you need to know about the Transmission of Shares, a process that allows the transfer of ownership when the original shareholder is no longer able to manage their shares. In this blog, we’ll walk you through the key points: What the transmission of shares is, the difference between transmission and transfer, and how the legal requirements work. By the end, you’ll be well-informed about the steps needed to complete the process and recover your lost shares.

What is Transmission of Shares?

Before diving into the process, it’s important to understand what transmission of shares means. Unlike a transfer of shares, where shares change hands voluntarily, while often through sale, transmission of shares happens due to legal circumstances. These may include the death, bankruptcy, or incapacity of the original shareholder. Essentially, it's an involuntary process where the legal heir or rightful owner becomes the new shareholder.

Now, you might be wondering how complex this could get. The good news? If you follow the correct

Transmission of Shares procedure, it’s relatively straightforward.

Why is the Transmission of Shares Important?

The transmission of shares is a legal necessity to ensure that the ownership of shares is properly transferred to the rightful party. Failing to go through the proper procedure could lead to disputes, delays, and even loss of ownership rights. Plus, without the appropriate documentation, companies won't recognize the new shareholder, leaving you with shares that are effectively frozen.

If you're someone

looking to recover lost shares or ensure your family inherits them, knowing the proper procedure for transmission-of-shares is essential.

Step-by-Step Guide to the Share Transmission Process

Let’s break down the

Share transmission Process into manageable steps so that you can approach it confidently:

- Check for Legal Heirs: The first step is identifying the rightful heir(s). If there is a will in place, it will specify the heirs. If not, the inheritance laws of the relevant jurisdiction will determine the successors.

- Obtain the Death Certificate: A death certificate is crucial if the transmission is due to the passing of a shareholder. This document must be submitted to the company or registrar along with other required forms.

- Submit Legal Documents: You'll need to submit specific legal documents that vary depending on the nature of the transmission:

- If the transmission is due to death, you may need a probate or succession certificate.

- If it’s due to bankruptcy, official documentation proving incapacity or legal ownership must be provided.

- Fill out Transmission Request Forms: Most companies have a set of forms specifically for transmission. Make sure to fill out these forms accurately, as incomplete forms can cause delays.

- Submit Share Certificates: In some cases, you may need to submit the original share certificates. If these are lost, you'll need to apply for duplicates before proceeding with the transmission process.

- Approval by the Company’s Board: Once the paperwork is submitted, the company’s board of directors reviews and approves the transmission.

- Update of Records: After approval, the company updates its records to reflect the new shareholder.

By following these steps, the

transmission of shares procedure becomes a smooth process, ensuring that your shares are correctly and legally transferred.

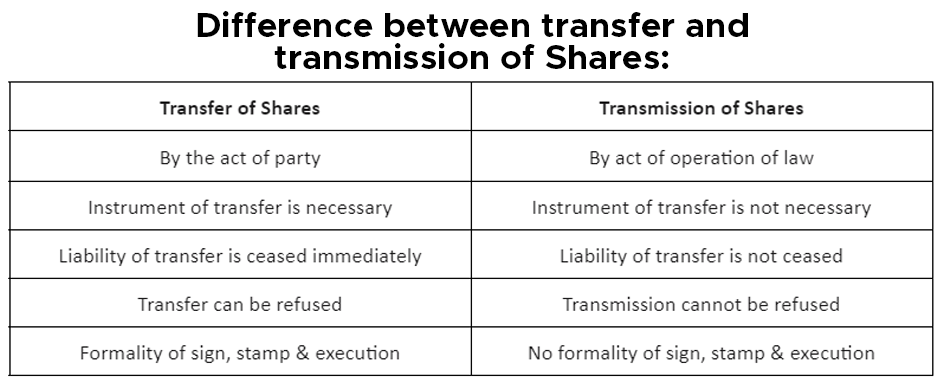

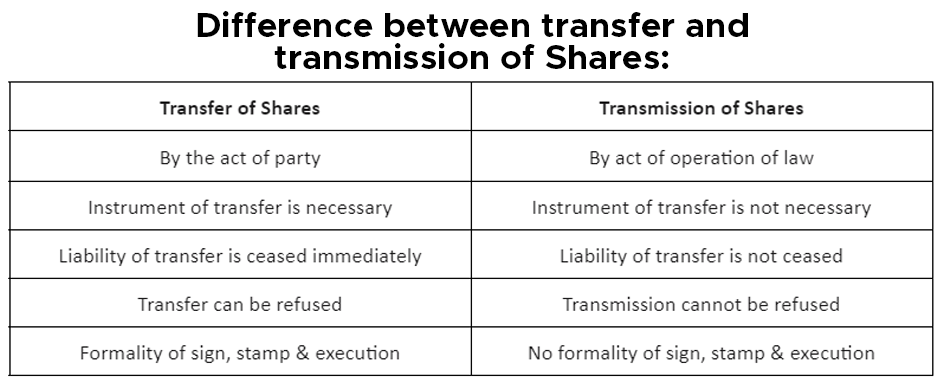

The Difference Between Share Transfer and Transmission of Shares

One common question that arises is: What is the difference between share transfer and transmission? Simply put:

- Share Transfer: This is a voluntary action where shares are transferred from one person to another by way of sale or gift.

- Transmission of Shares: This is an involuntary transfer that occurs due to legal reasons such as the death of a shareholder or mental incapacitation.

Both require different procedures, and while transfers involve a financial transaction, transmission usually does not.

Why Choose Shares Claim Dost for Your Share Recovery?

Recovering lost shares or navigating the Transmission of Shares process might feel complicated, but it doesn’t have to be. With over 15+ years of experience, 5000+ recovery cases, and 3000+ happy clients, Shares Claim Dost has the expertise and network to make the process quick and effective. We understand how important your shares are and have a strong connections network to ensure swift recoveries. Whether you’re managing a complex transmission or simply need help with lost shares, our team will guide you every step of the way. Our quick turnaround times and personalized service have made us a trusted partner in helping people recover their lost shares with minimal stress.

Don’t Let Legal Complications Stop You from Recovering What’s Rightfully Yours

Navigating the

transmission of shares may seem daunting, but with the right guidance, it can be a smooth and efficient process. Whether you’ve recently lost a loved one or are managing the estate of a family member,

Share Claim Dost is here to help. Our expert team will assist you every step of the way, making sure your shares are recovered in a timely manner. If you're unsure where to start or need assistance with the legalities, don’t hesitate to reach out. Your shares shouldn’t be left hanging, reclaim them today with the professionals who know exactly how to make it happen.

FAQs

What documents are required for the transmission of shares?

Ans. You will need documents like a death certificate, probate, or succession certificate, share certificates, and legal heir proof.

Can shares be transmitted without a will?

Ans. Yes, in cases where no will is present, the relevant inheritance laws of your jurisdiction will apply.

How long does the transmission process take?

Ans. The time varies depending on the complexity, but with the right documents in place, it usually takes a few weeks.

What happens if share certificates are lost?

Ans. You can apply for duplicate share certificates through the company before starting the transmission process.

Do I need to pay taxes on transmitted shares?

Ans. Generally, there are no taxes on transmitted shares, as they are passed through inheritance or legal succession, but always consult a tax advisor for your specific case.