Unclaimed dividends and shares are financial assets that have not been claimed by their rightful owners within a specified period. These assets can accumulate due to various reasons such as the owner’s unawareness, change of address, death, or simply forgetting about the investment. When dividends or shares remain unclaimed for seven consecutive years, they are transferred to the Investor Education and Protection Fund (IEPF). If you find yourself in this situation, recovering these unclaimed dividends and shares is crucial to reclaiming your financial assets. Shares Claim Dost is here to help you navigate this complex process smoothly.

There are several reasons why dividends or shares might go unclaimed:

If you have moved and didn’t update your address with the company, you might miss important communication regarding your dividends or shares.

If the shareholder passes away and the heirs are unaware of the investments, the assets may remain unclaimed.

Physical share certificates can be easily lost or misplaced over time.

Investors might not be aware of the dividends declared or shares held.

If a Demat account remains inactive for a long period, any dividends or shares associated with it may go unclaimed.

To recover your unclaimed dividends and shares, you need to provide specific documents. These include:

A duly filled and signed claim form (Form IEPF-5 for IEPF claims).

If shares are in physical form.

PAN card, Aadhaar card, or passport.

Recent utility bills, Aadhaar card, or passport.

Canceled cheque or bank statement with your name.

In case of the deceased shareholder.

For claiming shares and dividends of a deceased shareholder.

An affidavit as required by the authority.

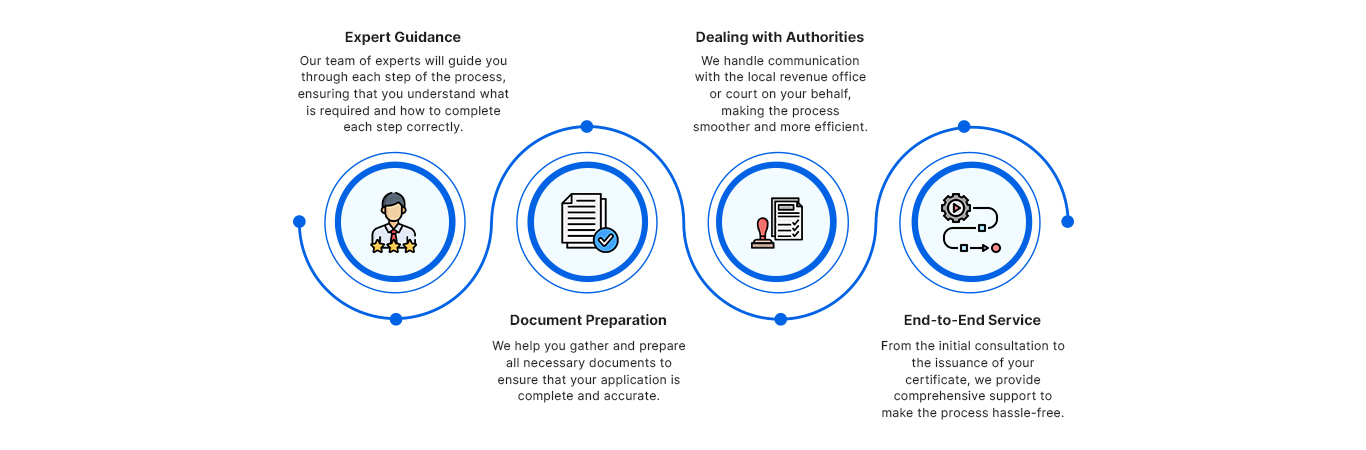

At Shares Claim Dost, we understand that recovering unclaimed dividends and shares can be a challenging process. We are here to make it easier for you. Here’s how we can assist you:

At Shares Claim Dost, we are committed to making the process of recovering unclaimed dividends and shares easy and hassle-free. Reach out to us now to begin the process and secure your financial assets.

Their team helped me convert my physical shares to demat effortlessly. Great support!

Their team helped me convert my physical shares to demat effortlessly. Great support!

I was able to recover my unclaimed dividends thanks to SharesClaimDost. Excellent service!

SharesClaimDost made reclaiming my lost shares easy and hassle-free. Highly recommend their services!

Explore our blog for tips and guides on reclaiming unclaimed shares and financial assets. Stay informed and take control of your investments with our expert advice.

Recovering unclaimed dividends involves steps that ensure shareholders can reclaim dividends

Learn More

Guide to the IEPF Claim Process

Learn More

Share Transfer and Share Transmission

Learn More

How You Can Claim Your Unclaimed Dividends and Shares

Learn More