Transmission of shares refers to the process of transferring the shares from the deceased shareholder to their legal heirs or nominees. It is different from the regular transfer of shares, which is an agreement between two parties when both are alive. By understanding the transmission of shares process you can deal with lost shares or manage the estate of a deceased loved one. At Shares Claim Dost, we provide expert assistance to make this process smooth and hassle-free.

Section 56 of the Companies Act, 2013, allows a company to register the transmission of securities. This means that

if someone legally inherits rights to securities, the company can update its records to show the new owner after

receiving the proper notification. Apart from this, there are some more scenarios where the transmission of shares

becomes necessary:

When a shareholder passes away, their shares need to be transmitted to the legal heirs or nominees.

If a shareholder becomes bankrupt, the shares may need to be transmitted to creditors.

If a shareholder is declared mentally incapable, the shares need to be transmitted to a legal guardian or trustee.

Understanding these scenarios can help you prepare for the necessary steps and documentation required for the transmission process.

The documentation required for the transmission of shares depends on whether the shareholder had left a will

(testate) or died intestate (without a will). Commonly required documents include:

An official document certifying the death of the shareholder.

Legal documents proving the right to inherit. It is not possible to complete transmission of shares without succession certificate.

The original share certificates held by the deceased

Identification documents of the heirs

A form provided by the company for initiating the transmission process.

Specimen signature of the successor.

In some cases, transmission of shares without a succession certificate is possible if the value of the shares is below a certain threshold, as

determined by the company's policies.

It is essential to understand the difference between transmission and transfer of shares:

Knowing this difference helps in understanding the legal and procedural complexities

involved in both processes.

If the deceased shareholder held shares in multiple companies, the transmission process needs to be initiated separately for each company. Each company may have its own set of requirements and procedures, making the process complex and time-consuming. Our team at Shares Claim Dost can assist in managing these multiple transmissions efficiently.

Issues Concerning Joint Shareholding In cases of joint shareholding, if one of the joint holders passes away, the shares are generally transmitted to the surviving joint holders. The surviving holders need to provide the death certificate and request the company to update the share records. Our experts can guide you through this specific situation to ensure all legalities are appropriately handled.

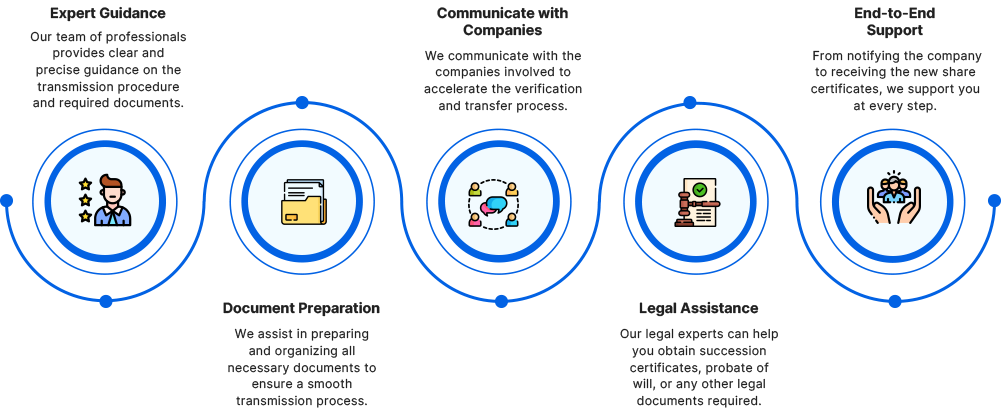

Managing the transmission of shares can be a complex task, especially during a time of grief or stress. Shares Claim Dost offers comprehensive services to help you through every step of the process:

Choosing Shares Claim Dost ensures that the transmission of shares is handled efficiently, legally, and with minimal hassle. Our dedicated team is here to help you reclaim your lost shares and manage the transmission process seamlessly. For more information or to start the transmission of shares process, contact us today. Let Shares Claim Dost be your trusted partner in reclaiming your financial assets.

Their team helped me convert my physical shares to demat effortlessly. Great support!

Their team helped me convert my physical shares to demat effortlessly. Great support!

I was able to recover my unclaimed dividends thanks to SharesClaimDost. Excellent service!

SharesClaimDost made reclaiming my lost shares easy and hassle-free. Highly recommend their services!

Explore our blog for tips and guides on reclaiming unclaimed shares and financial assets. Stay informed and take control of your investments with our expert advice.

Recovering unclaimed dividends involves steps that ensure shareholders can reclaim dividends

Learn More

Guide to the IEPF Claim Process

Learn More

Share Transfer and Share Transmission

Learn More

How You Can Claim Your Unclaimed Dividends and Shares

Learn More