Provident funds, often referred to as PF (Provident Fund), are savings schemes mandated by the government for employees in both public and private sectors. Employers and employees contribute a specific percentage of the employee’s salary into the fund. Provident funds are essential financial safety nets designed to support employees in their retirement years. These funds accumulate over an employee’s working life, ensuring they have financial security after retirement.

Recovering your provident fund may become necessary under various conditions, such as:

If you have changed jobs multiple times, your PF accounts might be scattered across different employers.

Upon retirement, you need to access the accumulated funds for your financial needs.

In cases where PF accounts have been dormant or unclaimed due to lack of awareness or incomplete documentation.

The nominees or legal heirs need to recover the provident fund of a deceased account holder.

Mistakes in account details or discrepancies in the records that need rectification for fund recovery.

To successfully recover your provident fund, you need to provide specific documents. Here is a checklist of the essential documents:

PAN Card, Aadhaar Card, or Passport.

Utility bills, bank statement, or Aadhaar Card.

Canceled cheque or bank passbook.

Provided by your employer.

If applicable.

Relieving letter or appointment letter from your employer.

In case of recovery due to the death of the account holder, a death certificate is required.

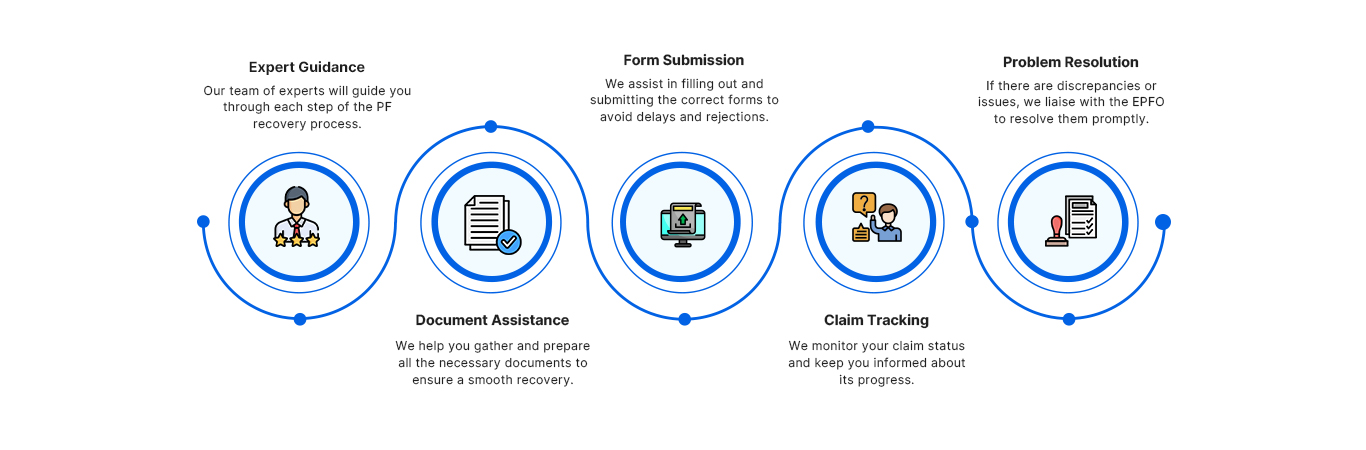

Understanding the recovery of provident fund can be challenging, but Shares Claim Dost is here to simplify the process. Here is how we can assist you:

At Shares Claim Dost, we are committed to helping you understand the complexities of recovering provident funds. Trust us to handle your update process efficiently and professionally. Contact us now!

Their team helped me convert my physical shares to demat effortlessly. Great support!

Their team helped me convert my physical shares to demat effortlessly. Great support!

I was able to recover my unclaimed dividends thanks to SharesClaimDost. Excellent service!

SharesClaimDost made reclaiming my lost shares easy and hassle-free. Highly recommend their services!

Explore our blog for tips and guides on reclaiming unclaimed shares and financial assets. Stay informed and take control of your investments with our expert advice.

Recovering unclaimed dividends involves steps that ensure shareholders can reclaim dividends

Learn More

Guide to the IEPF Claim Process

Learn More

Share Transfer and Share Transmission

Learn More

How You Can Claim Your Unclaimed Dividends and Shares

Learn More