Postal savings schemes are financial products offered by postal departments, typically backed by the government, providing a safe investment option with assured returns. These schemes include savings accounts, fixed deposits, recurring deposits, and other investment plans. They are popular due to their security, ease of access, and attractive interest rates. But, there can be instances where accessing these savings becomes complicated. At Shares Claim Dost, we specialize in the recovery postal savings, ensuring you can claim your money without hassle. Whether you have lost track of your savings, changed addresses, or encountered any other issues, we are here to help you recover what is rightfully yours.

There are several scenarios where you might need to recover your postal savings:

Important documents related to your postal savings can sometimes be lost or misplaced, making it difficult to access your funds.

If you have moved and not updated your address with the postal department, you might face challenges in accessing your savings.

Accounts that have been inactive for a long time can become dormant, requiring specific procedures to reactivate and recover the funds.

In the unfortunate event of the account holder’s death, the legal heirs or nominees need to claim the savings.

Mistakes in personal details or account information can lead to difficulties in accessing the savings.

To recover your postal savings, you need to provide specific documents. Here is a checklist of the essential documents:

PAN Card, Aadhaar Card, Passport, or Voter ID.

Utility bills, bank statements, or Aadhaar Card.

Passbooks, certificates, or account statements related to your postal savings.

Canceled cheque or bank passbook for account verification.

If applicable, nomination forms or legal heir certificates in case of the account holder’s death.

Documents showing your new address if you have relocated.

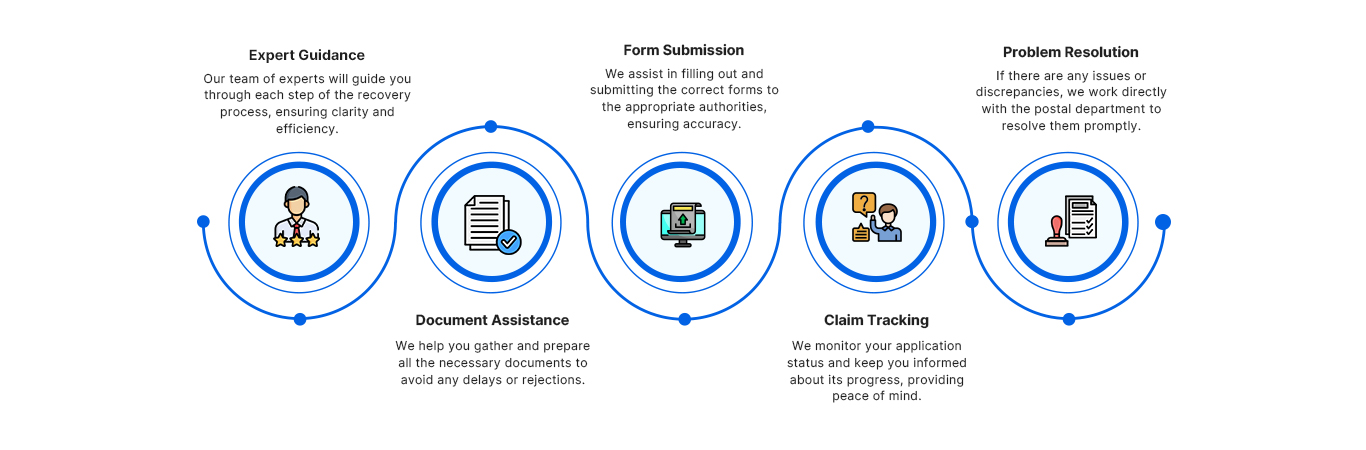

Understanding the recovery of postal savings can be daunting, but Shares Claim Dost is here to simplify the process. Here is how we can assist you:

At Shares Claim Dost, we are committed to helping you understand the complexities of recovering postal savings. Trust us to handle your update process efficiently and professionally. Contact us now!

Their team helped me convert my physical shares to demat effortlessly. Great support!

Their team helped me convert my physical shares to demat effortlessly. Great support!

I was able to recover my unclaimed dividends thanks to SharesClaimDost. Excellent service!

SharesClaimDost made reclaiming my lost shares easy and hassle-free. Highly recommend their services!

Explore our blog for tips and guides on reclaiming unclaimed shares and financial assets. Stay informed and take control of your investments with our expert advice.

Recovering unclaimed dividends involves steps that ensure shareholders can reclaim dividends

Learn More

Guide to the IEPF Claim Process

Learn More

Share Transfer and Share Transmission

Learn More

How You Can Claim Your Unclaimed Dividends and Shares

Learn More