Have you lost track of your shares or dividends over the years? You’re not alone. Many people find themselves in a situation where they’ve lost contact with their investments. This is where the Investor Education and Protection Fund (IEPF) comes into play. IEPF claims allow investors to reclaim their unclaimed shares, dividends, and other financial entitlements that have been transferred to the IEPF.

Understanding when you need to file an IEPF claim refund is crucial. Here are common scenarios:

If you have not claimed your dividends for seven consecutive years, they are transferred to the IEPF.

Shares that remain unclaimed or dormant for a significant period.

Fixed deposits and debentures that have matured but remain unclaimed.

Money that has not been claimed by investors who applied for shares.

Interest on matured deposits that has not been claimed.

If any of these situations apply to you, it’s time to initiate the IEPF claim process and reclaim your funds.

To process your IEPF claim refund, you need to prepare several documents. Here’s a checklist to help you get started:

Required if you are claiming lost shares.

Dividend warrants, interest warrants, etc.

PAN card, Aadhaar card, passport, or any government-issued ID.

Utility bills, Aadhaar card, passport, etc.

Cancelled cheque leaf, bank statement

If shares are held in demat form.

From your depository participant

Duly signed by the claimant.

Verified by the company

As specified by the IEPF authority

Having these documents ready ensures a smooth and swift IEPF claim refund process.

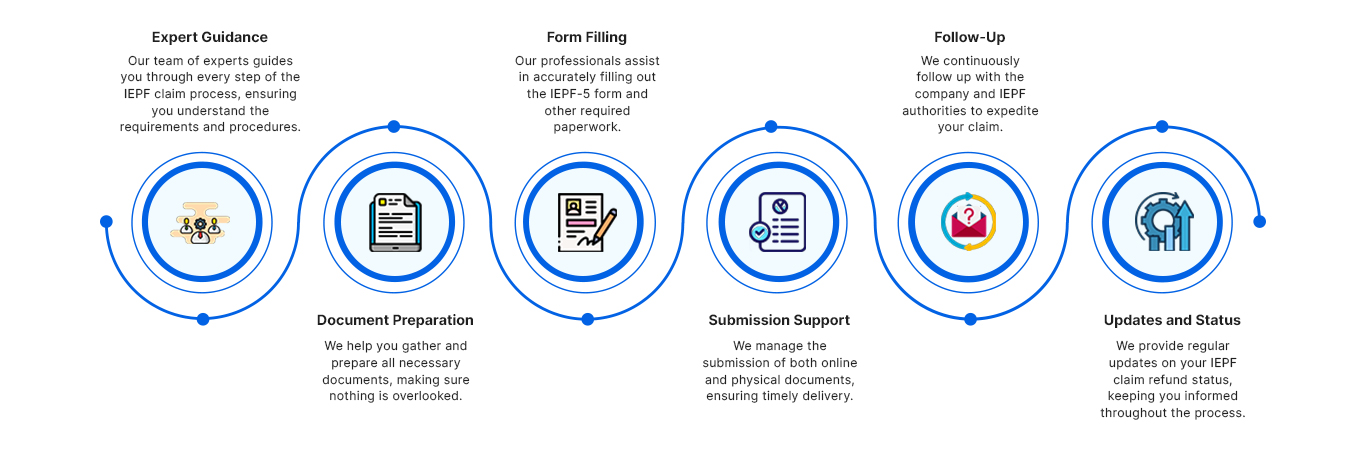

At Shares Claim Dost, we simplify the IEPF claim refund process for you. Here is how we assist:

Choosing Shares Claim Dost ensures that the process of IEPF claim refund is handled efficiently, legally, and with minimal hassle. Our dedicated team is here to help you claim your IEPF refund and manage the process seamlessly. For more information or to start the IEPF claim refund process, contact us today. Let Shares Claim Dost be your trusted partner in claiming your financial assets.

Their team helped me convert my physical shares to demat effortlessly. Great support!

Their team helped me convert my physical shares to demat effortlessly. Great support!

I was able to recover my unclaimed dividends thanks to SharesClaimDost. Excellent service!

SharesClaimDost made reclaiming my lost shares easy and hassle-free. Highly recommend their services!

Explore our blog for tips and guides on reclaiming unclaimed shares and financial assets. Stay informed and take control of your investments with our expert advice.

Recovering unclaimed dividends involves steps that ensure shareholders can reclaim dividends

Learn More

Guide to the IEPF Claim Process

Learn More

Share Transfer and Share Transmission

Learn More

How You Can Claim Your Unclaimed Dividends and Shares

Learn More