Recovering unclaimed dividends involves steps that ensure shareholders can reclaim dividends

Millions of individuals unknowingly miss out on dividends owed to them, with billions lying unclaimed in companies’ records or the Investor Education and Protection Fund (IEPF). This unclaimed wealth, often lost due to outdated records, unlinked bank accounts, or untraceable heirs, can actually be recovered by following the right steps. If you’re one of the many shareholders looking to reclaim your unclaimed dividends, understanding the recovery process, regulations, and key points involved is essential.

What are Unclaimed Dividends?

Dividends, while a fantastic form of passive income for shareholders, can often go unclaimed if shareholders miss receiving payments. The reasons vary—many shareholders relocate, change bank accounts, or lose track of their investments. If a dividend remains unclaimed for seven years, companies transfer it to the IEPF, where it can still be recovered, although with more procedural steps. This guide covers the essential information, legal pathways, and practical advice to help you navigate the

Recovery of Unclaimed Dividends and access funds owed to you.

Understanding Unclaimed Dividend Recovery

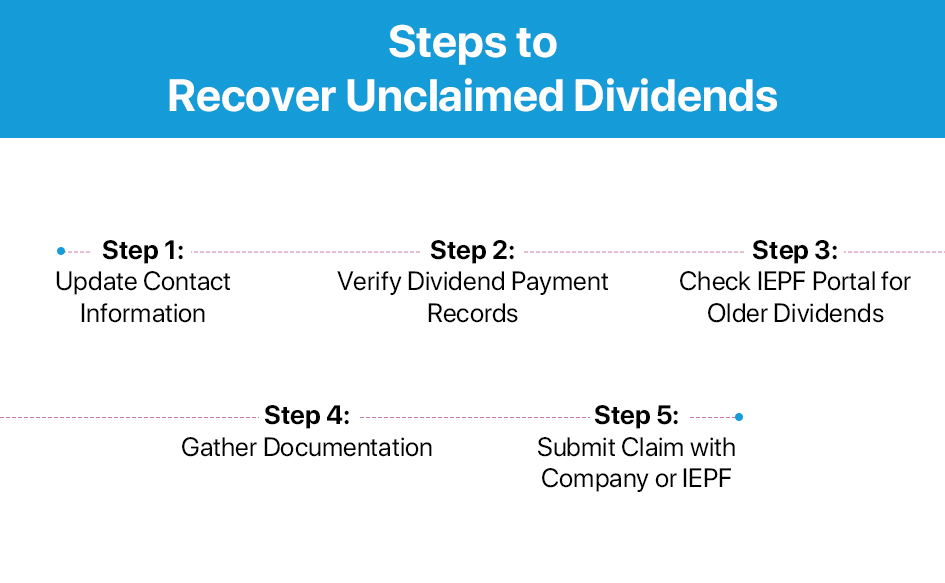

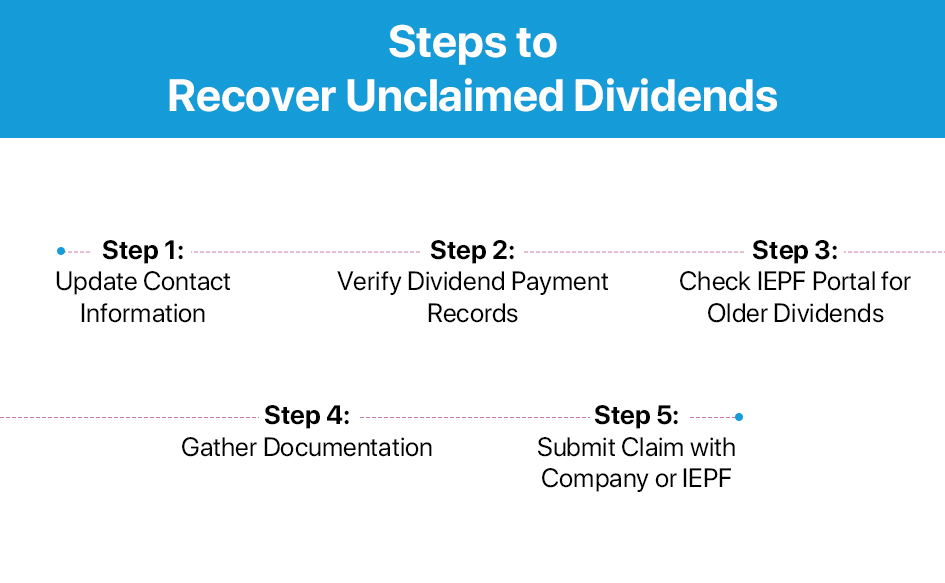

Recovering unclaimed dividends involves navigating regulatory steps that ensure shareholders can reclaim dividends safely and efficiently. To better understand the process, here’s what you should keep in mind:

1. Check Your Eligibility and Identify Unclaimed Dividends

Before beginning the recovery process, it’s essential to confirm whether you are eligible to claim these funds. Here’s how:

- Update your information: Ensure your contact information, address, and bank details are up-to-date with the companies you hold shares in.

- Review dividend payment history: Look over past statements or transaction history to verify any missed dividend payments.

- Check IEPF records: For dividends older than seven years, visit the IEPF portal to locate unclaimed dividend transfer to IEPF or any IEPF unclaimed shares you may be eligible to recover.

2. Documentation Essentials for Recovery

Gathering and organizing relevant documents is vital for a smooth recovery process. Each company may have specific requirements, so preparing beforehand will simplify your experience. Here are the basics:

- Identification proof: Government-issued ID, PAN card, and recent photographs.

- Shareholding proof: Obtain share certificates or proof of electronic holdings.

- Bank details: Ensure your account is verified with a cancelled cheque and KYC documents.

- IEPF Application Form: Download and fill out Form IEPF-5, required for claiming unclaimed dividends held by IEPF.

3. Steps in the Process to Claim Unclaimed Dividends

For shareholders wondering about the

process to claim unclaimed dividends, these steps provide a general roadmap:

- Contact the Company: Start by contacting the company or registrar where you hold shares. They can confirm if any unclaimed funds remain with them.

- Check with IEPF: If the dividends are transferred to IEPF, you will need to follow IEPF’s recovery process by submitting Form IEPF-5 online.

- Verification and Approval: After submitting the form, the company will verify your details and forward them to IEPF.

- Claim Refund: IEPF processes approved claims and initiates the refund process, transferring your funds directly to your verified bank account.

Why Do Funds Go Unclaimed?

Understanding why funds go unclaimed can help you avoid similar pitfalls. Here are some examples:

- Relocated with Old Contact Details: Rajesh, a shareholder, moved to a new city and forgot to update his records with the company. This meant all his dividend cheques were sent to his previous address.

- Unlinked Bank Account: Meena changed banks but didn’t update her dividend account. This led her dividends to bounce back, eventually moving to unclaimed dividend IEPF after seven years.

Both Rajesh and Meena could have reclaimed their dividends with updated information and a simple follow-up with their companies.

Challenges in Handling Unclaimed Funds and Ways to Overcome Them

The process of handling unclaimed funds can sometimes be complex, especially with regulations and necessary paperwork. Here are some common challenges and tips to overcome them:

- Complex Documentation: Ensure all your information is correctly filled out, with no discrepancies between records.

- Verification Delays: Regularly check with the company for updates and keep a copy of all submitted forms.

- Multiple Claims: If you have dividends from multiple companies, organize your claims carefully to avoid missing any.

The Role of Share Claim Dost in Dividend Recovery

When dealing with unclaimed dividends, Share Claim Dost provides professional assistance, simplifying the recovery process by managing all the detailed steps for you. From documentation to liaising with companies and IEPF, Share Claim Dost offers comprehensive services, including the following:

- End-to-End Assistance: Handling all necessary paperwork, filling out forms accurately, and ensuring your information aligns with regulatory requirements.

- IEPF Claim Filing: Share Claim Dost manages the filing process for unclaimed dividend transfer to IEPF, guiding you through every step for a hassle-free experience.

- Follow-ups and Verification: Dedicated support in liaising with both the company and IEPF for a smooth recovery process.

For shareholders, Share Claim Dost’s services offer peace of mind and faster results in reclaiming your funds.

Key Benefits of Recovering Unclaimed Dividends

Recovering your unclaimed dividends can provide financial benefits while preventing the hassle of lost investments. Here’s a quick overview:

- Financial Value: Claiming your funds provides a potential financial boost.

- Investment Monitoring: Regularly reviewing your portfolio and updating your information helps you keep track of unclaimed funds.

- Prevention of Future Losses: Once you’ve recovered unclaimed dividends, you’re more likely to monitor your investments and avoid missing future dividends.

Conclusion

Reclaiming unclaimed dividends is more than just recovering lost money, it’s about reclaiming your rightful investments and securing your financial portfolio. By staying proactive, understanding the required documents, and knowing the process to follow, you can ensure a smoother path to reclaim your dividends.

If you’re looking for support, we offer experienced guidance, managing each step with professionalism and care. Ready to recover your unclaimed dividends? Visit

Share Claim Dost today and take the first step toward reclaiming your rightful funds!

FAQs

What is the basic process to claim unclaimed dividends?

Ans. Begin by contacting the company where you hold shares. If the dividends are with IEPF, submit the necessary documentation through the IEPF portal.

How do I know if my dividends are transferred to IEPF?

Ans. Check with the company, or search IEPF’s online portal to see if your dividends are listed under unclaimed dividend transfer to IEPF.

Can I recover dividends held by IEPF?

Ans. Yes, by following the correct recovery process and filing Form IEPF-5, you can retrieve unclaimed dividend IEPF funds.

What documents are required for dividend recovery?

Ans. You’ll need identification proof, shareholding certificates, bank details, and a completed IEPF form.