Shares are vital assets representing ownership in a company. When circumstances change - such as selling your shares, gifting them, or transferring them due to inheritance, you need to go through a share transfer process. This procedure ensures that the legal ownership of the shares is correctly transferred to the new owner. It can be a complex process involving specific documentation and compliance with regulations. At Shares Claim Dost, we simplify the process for you, ensuring a smooth and hassle-free transfer of shares.

Transferring shares might be necessary in various situations, including:

When you decide to sell your shares to another party.

If you wish to gift your shares to a family member or friend

Transferring shares to heirs after the original owner's death.

During mergers, acquisitions, or internal restructuring.

Transferring shares when a shareholder passes away or exits the company.

To ensure a smooth share transfer process, specific documents are required. These generally include:

This is the standard form used for transferring shares.

The certificate representing the shares to be transferred.

For both the transferor and transferee, to verify their identities.

Such as Aadhaar card, passport, or utility bills for both parties.

If the transfer is being made by a company.

In case of transfer due to the death of the original shareholder.

If applicable, for transferring shares to a nominee

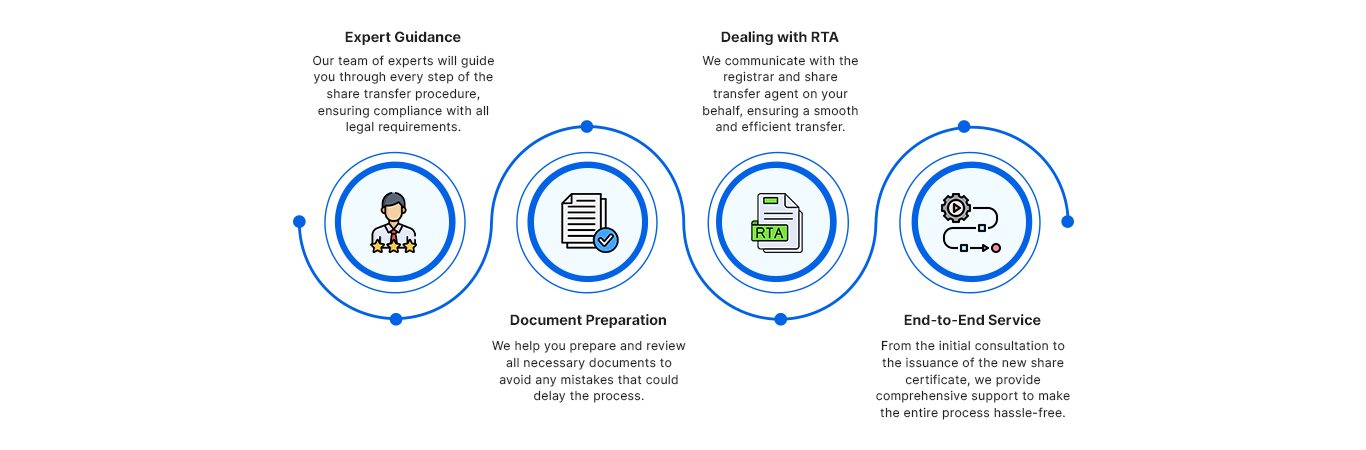

At Shares Claim Dost, we specialize in making the share transfer process seamless and stress-free. Here is how we can assist you:

At Shares Claim Dost, we are committed to helping you understand the complexities of share transfers with ease.

Trust us to handle your share transfer process efficiently and professionally. Contact us now!

Their team helped me convert my physical shares to demat effortlessly. Great support!

Their team helped me convert my physical shares to demat effortlessly. Great support!

I was able to recover my unclaimed dividends thanks to SharesClaimDost. Excellent service!

SharesClaimDost made reclaiming my lost shares easy and hassle-free. Highly recommend their services!

Explore our blog for tips and guides on reclaiming unclaimed shares and financial assets. Stay informed and take control of your investments with our expert advice.

Recovering unclaimed dividends involves steps that ensure shareholders can reclaim dividends

Learn More

Guide to the IEPF Claim Process

Learn More

Share Transfer and Share Transmission

Learn More

How You Can Claim Your Unclaimed Dividends and Shares

Learn More