Matured insurance refers to an insurance policy that has reached its end date or maturity period. At this point, the policyholder is entitled to receive the sum assured along with any accumulated bonuses or interest. This payout can provide significant financial relief or support for future investments. But, many people forget about their insurance maturity, move without updating their details, or their heirs are unaware of these policies. This can result in significant amounts of money remaining unclaimed. If you want to know how to claim LIC maturity amount online, Shares Claim Dost can help you understand the process and reclaim your funds.

Matured insurance can go unclaimed under several conditions:

Policyholders may move to a new address without informing the insurance company, leading to lost correspondence.

Heirs or beneficiaries may be unaware of the policy’s existence after the policyholder's death.

The payout checks may remain uncashed due to various reasons such as misplacement or oversight.

Policyholders may forget to follow up on their policy, leading to it becoming unclaimed.

To recover matured insurance, you will typically need the following documents:

A government-issued ID such as a PAN card, Aadhaar card, or passport.

A utility bill, bank statement, or any other official document showing your current address.

The original insurance policy document or policy number.

A canceled check or bank statement for verifying the account where the funds will be transferred.

If the original policyholder is deceased, a will, probate, or succession certificate may be required.

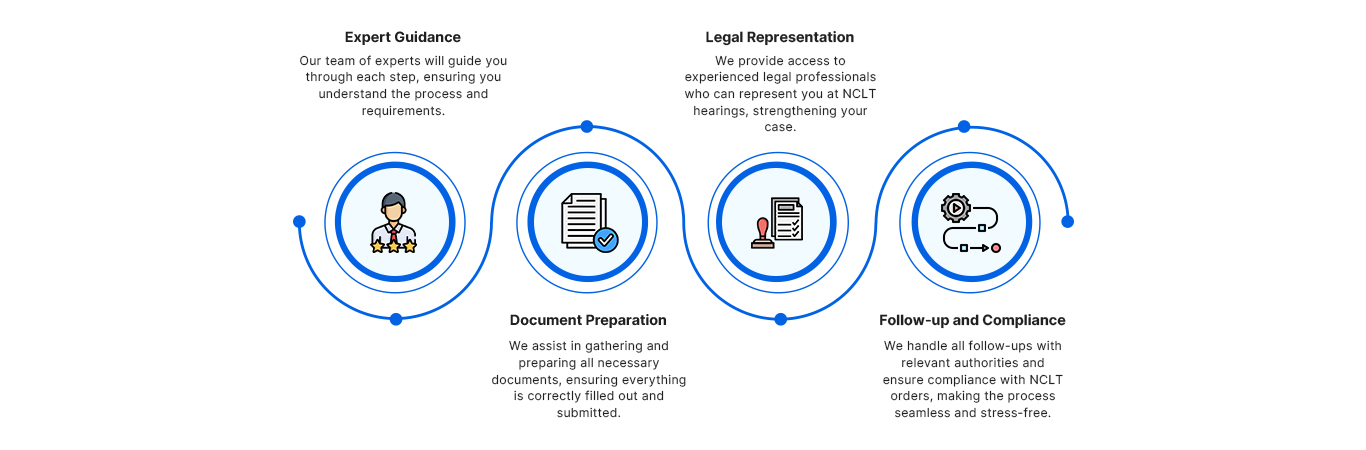

Shares Claim Dost specializes in the recovery of matured insurance policies in India. Here is how we can assist you:

At Shares Claim Dost, we are committed to helping you understand the complexities of recovering matured insurance policies. Trust us to handle your update process efficiently and professionally. Contact us now!

Their team helped me convert my physical shares to demat effortlessly. Great support!

Their team helped me convert my physical shares to demat effortlessly. Great support!

I was able to recover my unclaimed dividends thanks to SharesClaimDost. Excellent service!

SharesClaimDost made reclaiming my lost shares easy and hassle-free. Highly recommend their services!

Explore our blog for tips and guides on reclaiming unclaimed shares and financial assets. Stay informed and take control of your investments with our expert advice.

Recovering unclaimed dividends involves steps that ensure shareholders can reclaim dividends

Learn More

Guide to the IEPF Claim Process

Learn More

Share Transfer and Share Transmission

Learn More

How You Can Claim Your Unclaimed Dividends and Shares

Learn More