Matured deposits refer to investments that have reached their maturity date, meaning the original investment amount along with the accrued interest is now due to the investor. These deposits can come from various sources such as fixed deposits, recurring deposits, or company deposits. For many investors, these matured deposits represent significant financial resources that they rely on for various needs. In some cases, these deposits can get stuck in the Investor Education and Protection Fund (IEPF), making it challenging to access the funds.

Matured deposits can get stuck in the IEPF under the following conditions:

The deposit has remained unclaimed for seven years from the date of maturity.

The investor has not responded to reminders from the deposit-holding institution.

There have been no transactions or correspondence regarding the deposit for a specified period.

Recovering your matured deposits from the IEPF involves gathering and submitting the necessary documents. Here are the documents you will need for the matured deposit recovery:

Proof of Identity (Aadhar Card, PAN Card, Passport, etc.)

Proof of Address (Utility bills, Bank statement, etc.)

Original Deposit Certificate or Bond

Bank details for the transfer of recovered funds

A signed indemnity bond

A notarized affidavit

Canceled cheque or bank passbook

Any correspondence related to the deposit (if available)

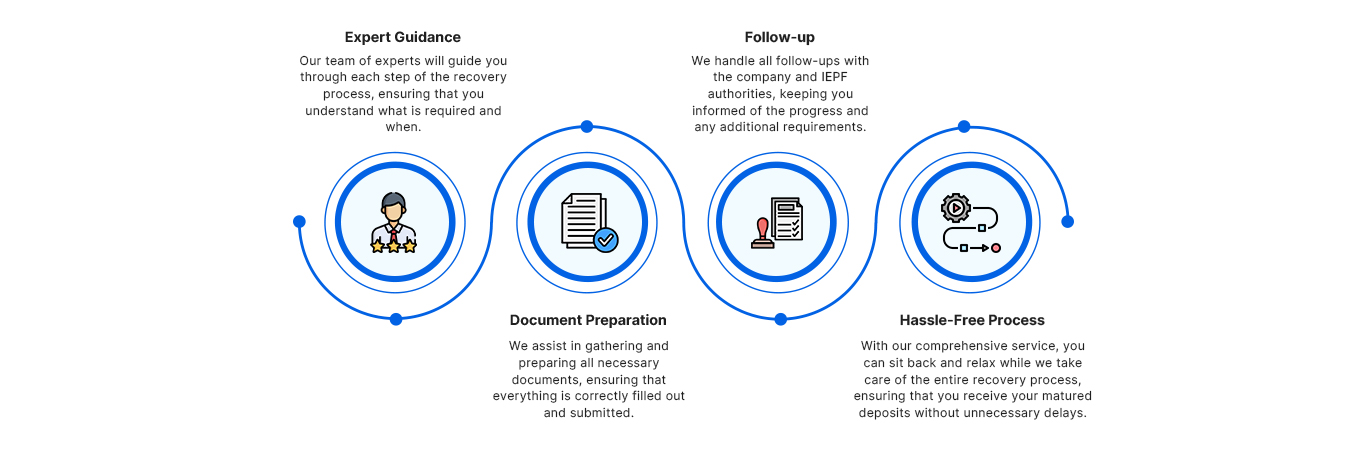

Understanding the recovery process for matured deposits from the IEPF can be complex and time-consuming. This is where Shares Claim Dost can help to simplify the process for you. Here is how we can help:

At Shares Claim Dost, we are committed to helping you understand the complexities of recovering matured deposits from the IEPF. Trust us to handle your update process efficiently and professionally. Contact us now!

Their team helped me convert my physical shares to demat effortlessly. Great support!

Their team helped me convert my physical shares to demat effortlessly. Great support!

I was able to recover my unclaimed dividends thanks to SharesClaimDost. Excellent service!

SharesClaimDost made reclaiming my lost shares easy and hassle-free. Highly recommend their services!

Explore our blog for tips and guides on reclaiming unclaimed shares and financial assets. Stay informed and take control of your investments with our expert advice.

Recovering unclaimed dividends involves steps that ensure shareholders can reclaim dividends

Learn More

Guide to the IEPF Claim Process

Learn More

Share Transfer and Share Transmission

Learn More

How You Can Claim Your Unclaimed Dividends and Shares

Learn More