A Demat (Dematerialized) account is an electronic account that holds your shares and securities in digital form, eliminating the need for physical share certificates. With the evolution of the financial markets, transforming physical shares into Demat shares has become essential. If you're still holding physical shares, it is time to consider converting them to a Demat account for better security, accessibility, and ease of transactions. Shares Claim Dost is here to guide you through this transformation seamlessly.

Converting your physical shares to Demat shares offers numerous benefits:

Demat shares are stored electronically, eliminating the risk of loss, theft, or damage that comes with physical certificates.

Buying, selling, and transferring shares is quicker and more efficient with a Demat account. It streamlines the entire process, saving you time and hassle.

All your investments are consolidated in one place, making it easier to manage and monitor your portfolio.

Electronic storage minimizes the need for extensive paperwork, making the process of maintaining your shares much simpler.

A Demat account allows you to trade online, giving you access to real-time information and the ability to act quickly on market changes.

Any changes such as bonuses, splits, or dividends are automatically updated in your Demat account.

To open a Demat account and convert your physical shares, you need to provide specific documents. These include:

PAN card, Aadhaar card, passport, or driving license.

Utility bills, Aadhaar card, passport, or voter ID card.

Canceled cheque or bank statement with your name.

Recent photographs for account opening forms.

For trading in derivatives, income proof such as salary slip or IT return may be required.

Original certificates of the shares you wish to dematerialize.

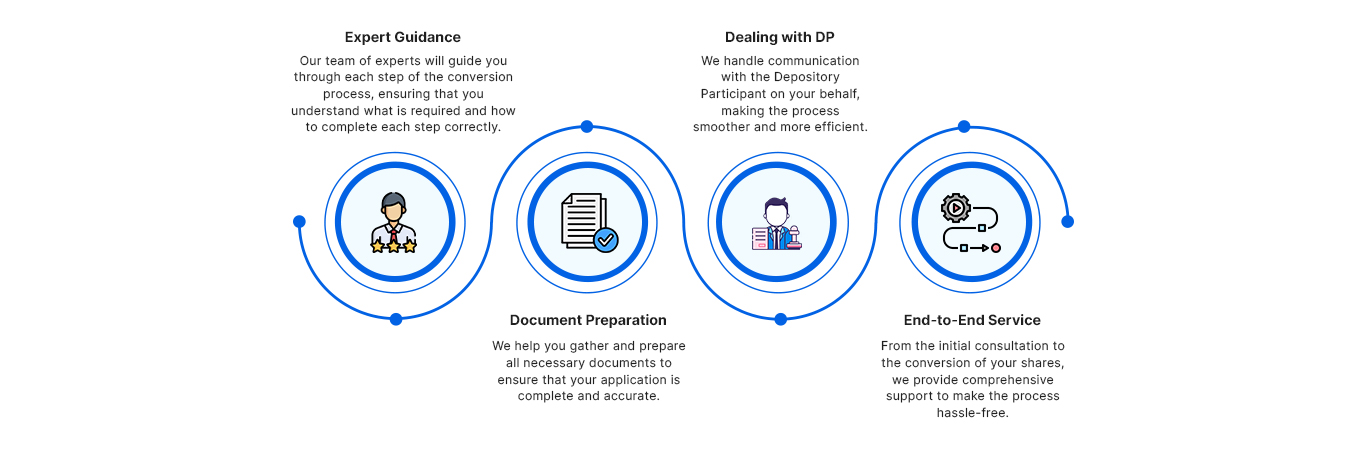

At Shares Claim Dost, we simplify the process of converting physical shares to Demat shares, ensuring a smooth and hassle-free experience. Here is how we can assist you:

At Shares Claim Dost, we are committed to making the process of converting physical shares to Demat easy and hassle-free. Reach out to us now to begin the process and secure your financial assets.

Their team helped me convert my physical shares to demat effortlessly. Great support!

Their team helped me convert my physical shares to demat effortlessly. Great support!

I was able to recover my unclaimed dividends thanks to SharesClaimDost. Excellent service!

SharesClaimDost made reclaiming my lost shares easy and hassle-free. Highly recommend their services!

Explore our blog for tips and guides on reclaiming unclaimed shares and financial assets. Stay informed and take control of your investments with our expert advice.

Recovering unclaimed dividends involves steps that ensure shareholders can reclaim dividends

Learn More

Guide to the IEPF Claim Process

Learn More

Share Transfer and Share Transmission

Learn More

How You Can Claim Your Unclaimed Dividends and Shares

Learn More