Have you lost track of your shares or dividends? When shares and dividends go unclaimed, they are transferred to the Investor Education and Protection Fund (IEPF). Recovering these shares is important to reclaim your investment and ensure your financial assets should not be lost forever. At Shares Claim Dost, we simplify the process of recovery of shares from IEPF, making it easy for you to regain your lost investments.

Your shares or dividends might got stuck in IEPF due to several reasons, including:

If dividends are unclaimed for seven consecutive years, the shares and dividends are transferred to IEPF.

If you have moved and missed important communications from the company regarding your shares or dividends.

Physical share certificates can get lost or misplaced over time.

Shares inherited but not claimed due to lack of awareness or proper documentation.

Inactive demat accounts can lead to shares being transferred to IEPF.

To recover your IEPF unclaimed shares, you need to submit specific documents. These include:

Duly filled and signed by the claimant.

Generated after submitting Form IEPF-5 online

On a non-judicial stamp paper, signed by the claimant.

Signed by both the claimant and witnesses.

If shares are in physical form.

If securities are in demat form.

Copy of PAN card for identification.

Copy for address proof.

For bank account verification.

Documents proving your claim, such as share certificates or dividend warrants.

Passport, OCI, or PIO card for non-resident Indians and foreigners.

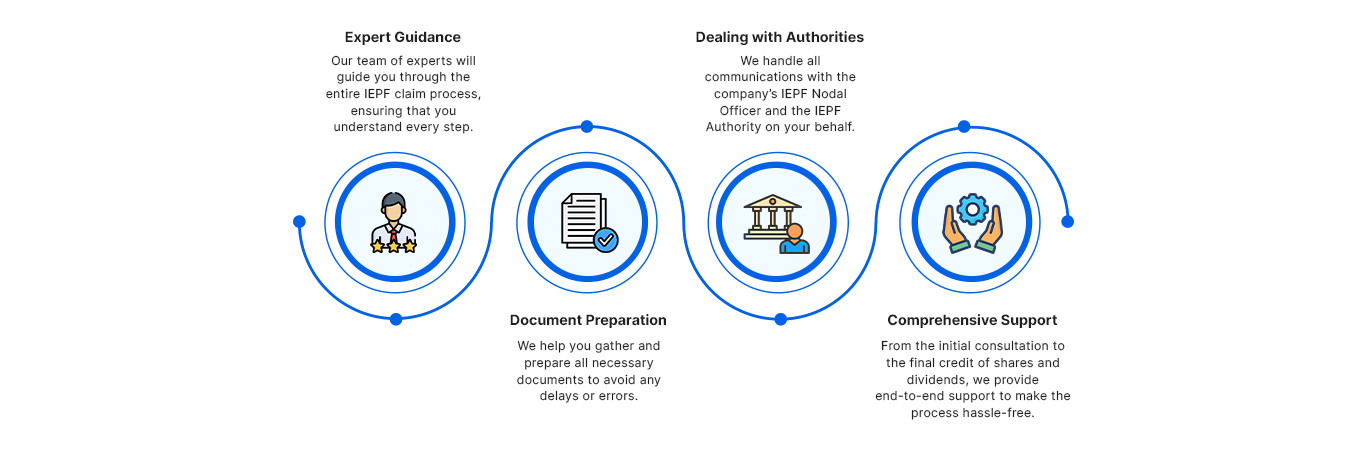

At Shares Claim Dost, we simplify the IEPF claim refund process for you. Here is how we assist:

Their team helped me convert my physical shares to demat effortlessly. Great support!

Their team helped me convert my physical shares to demat effortlessly. Great support!

I was able to recover my unclaimed dividends thanks to SharesClaimDost. Excellent service!

SharesClaimDost made reclaiming my lost shares easy and hassle-free. Highly recommend their services!

Explore our blog for tips and guides on reclaiming unclaimed shares and financial assets. Stay informed and take control of your investments with our expert advice.

Recovering unclaimed dividends involves steps that ensure shareholders can reclaim dividends

Learn More

Guide to the IEPF Claim Process

Learn More

Share Transfer and Share Transmission

Learn More

How You Can Claim Your Unclaimed Dividends and Shares

Learn More